How to Pay for a Wedding and Save Money Wisely

- Author: Natali Grace Levine

- Reading time: 6 min 25 sec

- Publication date: 03/14/2024

- Updated: 01/21/2025

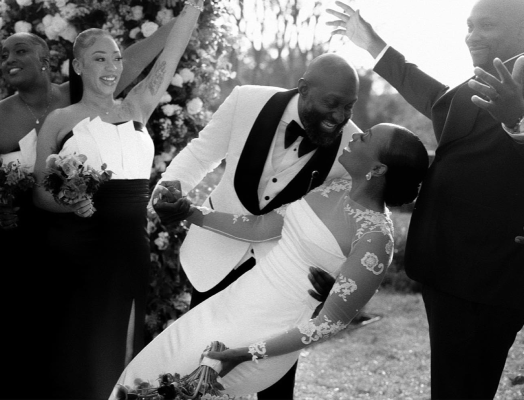

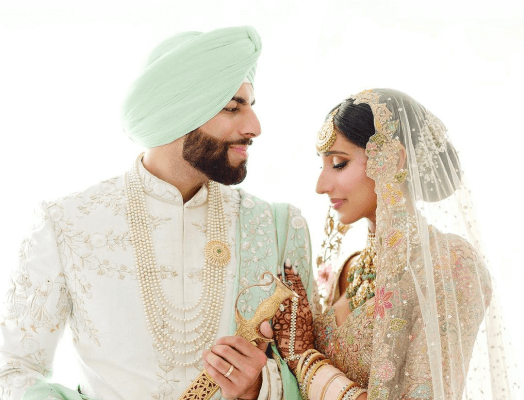

A wedding marks a beautiful new chapter, though costs run high and planning can feel overwhelming. Today's average $28,000 price tag means prudent budgeting is essential for American couples to manifest their dream celebration without drowning in debt. Smart saving and money management shine bright when financial demands loom. From venues to photographers, tallying expenses raises valid concerns over affordability.

This thorough guide explores pragmatic approaches to funding a wedding through early preparation, savings discipline, and thoughtful spending. Proactive cost-saving measures like dedicated funds and negotiated vendor pricing relieve monetary strain. With proper fiscal forethought, you can allocate resources wisely while focusing energy on cherished memories - not looming bills. Creative budgeting empowers your vision and sustains lasting financial health as you embark on this exciting marital journey together. When costs feel daunting, remember that simple shifts unlock a big impact on your intentional investment in love!

Find Your Perfect Wedding Vendors

How to Pay for a Wedding

When it comes to paying for a wedding, couples are often overwhelmed by the sheer amount of expenses involved. Here, we'll explore seven practical methods to help you tackle this daunting challenge. Whether you're just starting to plan or are well into the process, these strategies can provide valuable insights and inspiration to help you navigate the financial complexities of your big day.

Personal Savings

Building a dedicated wedding fund through consistent personal savings is often the foundation of a solid financial plan. Start setting aside a portion of your income as early as possible, ideally at least a year before your target date. Automating regular transfers into a separate savings account can help make this process seamless and keep you on track.

Family Contributions

If you're fortunate enough to have supportive family members willing to contribute, don't be afraid to have open and honest conversations about their potential financial assistance. However, it's crucial to approach this delicately and avoid putting undue pressure on loved ones. Set clear expectations and express genuine gratitude for any help they can provide.

Credit Cards

While using credit cards for wedding expenses should be a last resort, some couples may find themselves relying on them for certain costs. If you choose this route, be sure to have a clear repayment plan in place and opt for cards with low or no interest rates during the introductory period. Avoid maxing out your credit limits and prioritize paying off the balance as quickly as possible.

Wedding Loans

Financial institutions often offer specialized wedding loans, but these typically come with high interest rates and rigid repayment terms. Before considering this option, carefully weigh the long-term implications and explore alternative options that may be less costly in the long run.

Crowdfunding

Online crowdfunding platforms have become increasingly popular for couples seeking financial support from their community. While this can be a viable option for some, it's essential to manage expectations and be prepared for the possibility that not everyone may be comfortable or able to contribute.

Cutting Costs

Reevaluating your wedding budget and finding creative ways to reduce expenses can significantly lower the overall financial burden. Consider opting for a smaller, more intimate guest list, choosing an alternative venue, DIYing decorations, or negotiating with vendors to find cost-saving opportunities without compromising the essence of your special day.

Side Hustles

Taking on a part-time job or starting a side business can help generate additional income specifically earmarked for your wedding fund. From freelance work to selling handmade goods or renting out a room on Airbnb, these side hustles can provide a welcome financial boost while also teaching valuable budgeting and money management skills.

By exploring these seven strategies and tailoring them to your unique circumstances, you can design a financial plan that works for you and your partner, ensuring that your wedding day is a joyous celebration without the weight of overwhelming debt.

How to Save for a Wedding

Saving for a wedding requires discipline, creativity, and a strategic approach, especially if you’re wondering how to save for a wedding in a year. With proper planning and execution, it is absolutely possible to amass the necessary funds to make your dream day a reality without compromising your long-term financial stability.

Create a Realistic Budget

Start by listing every potential expense, no matter how small. Research local vendor pricing, get quotes, and account for tips. Build in a contingency fund of 10-15% for unexpected costs. Categorize expenses as needs vs. wants to identify areas to cut back. Review your budget regularly and adjust as plans evolve. Prioritizing needs first ensures you cover the essentials within your means. Having a clear number to work towards makes the saving process more manageable.

Automate Your Savings

Set a recurring transfer on payday so funds move before you can spend them. Start with a small, manageable amount and increase over time as you monitor cash flow. Keep the savings in an interest-bearing account to earn a bit extra. Celebrate milestones, like saving your first $1,000, to stay motivated. Consider increasing automated transfers when you receive raises or pay off debts. Avoid the temptation to reduce or skip transfers by making your goal a top priority. Consistency and commitment are key to success.

Cut Discretionary Spending

Review bank and credit card statements for areas to trim, like dining out, entertainment subscriptions, travel, or hobbies. Making coffee at home saves $100s per month. Cook home meals using grocery lists and planning affordable, healthy meals. Call service providers to negotiate for discounts or better package rates. Thrift stores and secondhand shops offer quality clothes and household items for less. Borrowing books, movies, and games from libraries beats buying. Focus on spending only on needs and delay wants until after the wedding. Trim unnecessary expenses systematically. Small spending adjustments add up significantly over time when dedicated to purposeful wedding savings.

Downsize Living Space

If location allows, move back home with parents temporarily to save big on rent. Get a roommate to share costs for rent, utilities, internet, and even groceries. A smaller, more affordable apartment closer to work can save on commuting costs too. Making short-term housing sacrifices for long-term wedding fund gains pays off. Be creative with your space and practice minimalist living during this saving period. Remind yourself it's not permanent.

Sell Unused Items

Sort your home ruthlessly, garage and storage spaces included. Collectibles, electronics, designer fashion, jewelry, vintage items, and antique furniture can bring in decent money. Research product values before pricing. Use online selling platforms, consignment shops, or community classifieds. Consider bundling smaller items together into lots. Quality photos, detailed listings, and speedy shipping earn positive reviews. Celebrate each sale putting cash straight into wedding savings. Challenge yourself to live with less during this time.

Negotiate Better Deals

Review all monthly bills line by line to identify areas to reduce costs. Research competitor pricing for leverage. remaining polite but firm gets better results. Speak to retention/loyalty teams for additional discounts. Request lower rates in exchange for bundled services. Ask about available limited-time promotions. Be ready to switch providers for greater overall savings. Follow up periodically as markets change. Smart consumers get the best deals.

Take on Side Work

Evaluate your skills, talents, and availability to monetize sensibly. Pet sitting, tutoring, freelance writing, and virtual assisting are flexible options. Drive for a rideshare or food delivery service. Staff events for catering companies. Offer services like lawn care, home cleaning, or handy work. Teaching music lessons utilizes your passion. Making and selling crafts or baked goods taps your creativity. Set rates competitively. Track earnings and expenses. Dedicate all profit entirely to savings. Hustle now to reduce life-long wedding debt.

Use Windfall Cash

Before spending bonuses, tax refunds, or gifts, calculate what percentage can responsibly fund wedding savings. Set a rule like 50% allocated to savings. Having a plan removes the temptation to splurge aimlessly. Adjust your automated transfers higher in those months too. If receiving large sums, consult financial advisors for strategic budgeting advice. Make windfalls work hard to grow your savings faster. A disciplined approach amplifies their impact.

Separate Wedding Savings

Opening a new account makes wedding cash psychologically less accessible day-to-day. Name it "wedding fund" as a visual reminder of purpose. Some banks offer bonus rates when opening dedicated savings accounts. Look into the money market or CD options for higher interest. Enforce a cool-down period before withdrawing deposited cash. Avoiding commingling funds maintains focus. Check balances weekly to track progress. Let the growing total motivate you.

DIY Decor and Details

Get creative with do-it-yourself projects for your wedding decorations and details. Not only will this allow you to save for a wedding, but it also allows you to personalize your big day. Start on DIY elements early to give yourself enough time. Some ideas to consider include:

- Calligraphy signage, seating charts, and place cards

- Centerpiece arrangements using thrifted vases, Mason jars, or repurposed containers

- Homemade favors such as cookies, candies, or potpourri sachets

- Garlands and backdrops made from fabric, twine, or paper

- Custom-printed invitations, programs, and menus

- Table runners and napkins sewn by seamstress family and friends

- DIY bouquets, boutonnieres, and ceremony arches with fabric flowers

Recruit help from crafty friends and family for assembly nights, and draw inspiration from online tutorials on Pinterest and YouTube. With some creativity, elbow grease, and planning, DIY decor can beautifully personalize your wedding while significantly reducing costs.

By implementing these ten tips and staying committed to your savings plan, you can make your dream wedding a reality without compromising your financial future!