Protect Your Special Day: Understanding Wedding Insurance

- Author: Natali Grace Levine

- Reading time: 9 min 26 sec

- Publication date: 09/10/2024

- Updated: 01/09/2025

- What is Wedding Insurance?

- Types of Wedding Insurance Coverage

- When to Purchase Wedding Insurance

- How Much is Wedding Insurance?

- Factors Affecting Wedding Insurance Costs

- Key Exclusions and Limitations

- Is Wedding Insurance Worth It?

- Choosing the Right Wedding Insurance Provider

- Wedding Insurance vs. Venue Insurance

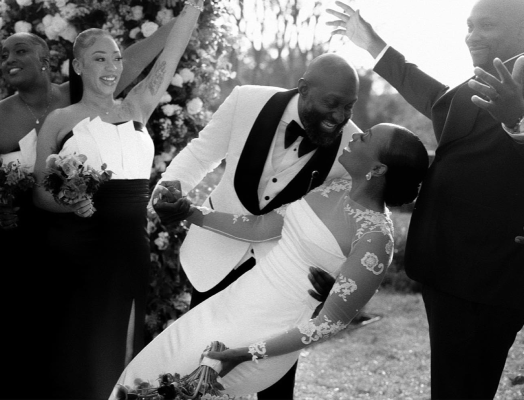

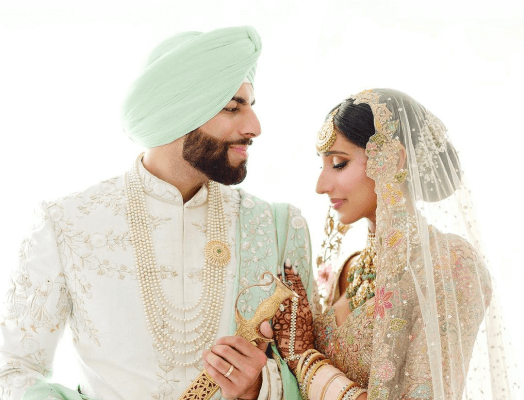

Planning a wedding can feel like you’re piecing together a beautiful, intricate puzzle. Each detail, from the floral arrangements to the guest list, fits together to create one of the most memorable days of your life. But what happens when something goes awry? That’s where wedding insurance steps in. Much like a safety net for your special day, it ensures that you’re covered financially if unexpected events disrupt your plans. Let’s dive into what wedding insurance is, why you might need it, and how to choose the right policy for your wedding.

Find Your Perfect Wedding Vendors

What is Wedding Insurance?

Wedding insurance is essentially a type of event insurance that covers you financially if certain aspects of your wedding need to be postponed, canceled, or if you face issues with vendors. Think of it as your plan B, ensuring that the investments you make in your big day are protected against unforeseen circumstances.

Types of Wedding Insurance Coverage

Wedding insurance offers a variety of coverage options to ensure that nearly every aspect of your big day can be protected against unforeseen circumstances. Understanding what does wedding insurance cover can help you tailor a policy that suits your specific needs.

Cancellation/Postponement Coverage

This type of insurance is crucial for recovering costs if your wedding needs to be canceled or postponed due to unexpected events like severe weather, illness, injury, or other significant disruptions. It can cover lost deposits, caterer fees, venue costs, and other non-refundable expenses.

Liability Coverage

Liability insurance is important for protecting yourself against claims for property damage or bodily injury that might occur at your wedding. This could include damage to the venue caused by a guest or an injury that happens during the event. Some venues may require you to have this type of insurance before allowing you to book.

Liquor Liability Coverage

If you plan to serve alcohol at your wedding, liquor liability is essential. It protects you against liability for injuries or damages caused by intoxicated guests. This is especially important if you’re serving alcohol under your own arrangements rather than through a licensed bartender or vendor.

Vendor No-show Coverage

If a key vendor such as your caterer, photographer, or band fails to show up, this coverage can help reimburse you for the lost deposit and potentially cover the cost of arranging last-minute replacements.

Personal and Professional Liability Coverage

This extends beyond basic liability to cover incidents that may not be directly related to property damage or personal injury but could involve emotional distress or other less tangible harms.

Honeymoon Coverage

Often considered under the umbrella of wedding insurance, honeymoon coverage can protect your investment in your post-wedding trip. This can include trip cancellation due to the same reasons covered by wedding cancellation insurance.

When to Purchase Wedding Insurance

The timing of purchasing wedding insurance is critical to ensure you maximize the benefits and coverage it offers. Ideally, you should consider buying a policy as soon as you start making significant deposits or financial commitments for your wedding. This is because most policies cover deposits from the date of purchase, so securing insurance early can help protect these initial investments.

Typically, wedding insurance can be purchased up to two years in advance of your wedding date, allowing you to safeguard every step of your wedding planning process. On the flip side, insurers usually have a cut-off point, often around 15 days before the event, after which you may not be able to buy a new policy. This timeframe ensures that coverage is in place well before any imminent risks or issues could arise.

How Much is Wedding Insurance?

The cost of wedding insurance can vary widely. However, to give you a general idea of current pricing:

- Basic Policies: These often start as low as $75 to $200. These basic policies typically cover issues like lost deposits, a no-show vendor, or minor damages.

- Comprehensive Coverage: For broader protection that includes cancellation and postponement, liability, and additional riders like liquor liability or additional expense coverage, prices can range from $200 to $1,000 or more. The variance largely depends on the total insured amount and the specific risks covered.

- Cancellation and Postponement: The cost for cancellation or postponement coverage usually correlates closely with the overall wedding budget. As a rule of thumb, you might expect to pay a premium of about 1-2% of the total cost of the wedding. For example, if your wedding budget is $30,000, the insurance for cancellation and postponement could cost between $300 and $600.

- Liability Coverage: This can also vary but is often in the ballpark of $185 to $500 for a typical wedding, depending on the number of guests and the specific liabilities covered.

For the most accurate and up-to-date pricing, it’s advisable to get quotes from several insurance providers based on the specific details of your wedding. This allows you to compare different options and select the coverage that best fits your needs and budget.

Factors Affecting Wedding Insurance Costs

The cost of wedding insurance can vary significantly based on several factors. Understanding these can help you estimate the potential cost of your policy and make informed decisions about the coverage you need.

Overall Wedding Budget

The total cost of your wedding is a primary factor in determining the price of your insurance policy. Higher-budget weddings typically require more extensive coverage due to the increased costs associated with venues, vendors, and services. Consequently, the more you plan to spend on your wedding, the higher the insurance cost will likely be to protect those investments.

Level of Coverage

The scope and limits of coverage you choose also play a crucial role in the cost of your insurance. Opting for a policy with higher coverage limits or additional riders for things like extreme weather conditions, military deployment, or specific high-value items such as heirloom jewelry will increase the premium.

Location of the Wedding

The location of your wedding can impact insurance costs due to varying risks associated with different areas. For example, weddings in urban areas might carry higher liability premiums due to the increased likelihood of accidents or damages. Similarly, destinations known for extreme weather conditions may have higher costs for cancellation and postponement coverage.

Number of Guests

The size of your wedding also affects the cost of insurance. Larger weddings can increase the likelihood of claims for issues like property damage or personal injury, leading to higher liability insurance costs.

Previous Claims History

If you have a history of insurance claims related to events, insurers might view you as a higher risk, which could increase the cost of your wedding insurance policy.

Timing of Purchase

When you buy your wedding insurance can affect its cost. Purchasing coverage well in advance can sometimes reduce the premium as it gives insurers more confidence in the stability and planning of your event.

Key Exclusions and Limitations

While wedding insurance provides essential coverage for many unexpected events that can disrupt your big day, it's equally important to understand what it does not cover. Certain exclusions and limitations are standard across most policies, and knowing these can help you manage your expectations and potentially arrange additional protection if necessary.

Change of Heart

Most wedding insurance policies do not cover cancellations due to a change of heart by the bride, groom, or other key parties. This exclusion ensures that the insurance covers only uncontrollable events and not personal decisions.

Known Conditions

Events that are foreseeable or conditions known at the time of purchasing the insurance are typically not covered. For example, if you plan a wedding in the Caribbean during hurricane season, any disruptions due to a hurricane may not be covered without a specific weather-related rider.

War and Civil Unrest

Issues arising from war, civil unrest, or terrorist activities are usually excluded from standard wedding insurance policies. These events are considered beyond the control and prediction scopes of both the insured and the insurer.

Illegal Acts

Any losses resulting from illegal activities or operations by the insured party or the event participants will not be covered under wedding insurance.

Financial Issues Beyond Specific Vendor Failures

While vendor failure due to bankruptcy or non-appearance is covered, broader financial crises that affect your ability to pay for the wedding are generally not covered.

Pre-existing Medical Conditions

If the cancellation or postponement is due to medical issues that were known before securing the insurance, these may not be covered unless specifically stated in the policy.

Weather Conditions Not Severe Enough to Legally Impede

Minor weather inconveniences that do not legally prevent the wedding from taking place are typically not covered. Insurance usually steps in when severe weather legally or logistically makes it impossible to hold the event.

Pandemics and Epidemics

Some insurers exclude coverage for cancellations or disruptions caused by widespread health crises such as pandemics or epidemics. This became particularly notable during the COVID-19 pandemic.

Non-Appearance of Non-Essential Participants

The non-appearance of guests who are not essential to the ceremony, such as friends or distant relatives, is generally not covered. Insurance tends to focus on those whose absence would legally or significantly disrupt the proceedings.

Mechanical Breakdowns or Technical Issues

Problems such as transportation breakdowns, technical issues with audio-visual equipment, or other mechanical failures might not be covered unless they result in a significant impact on the ceremony or reception.

Is Wedding Insurance Worth It?

Wedding insurance is a strategic choice for those investing significant financial and emotional resources into their special day. It acts as a safeguard, offering financial reimbursement and peace of mind against unforeseen events such as severe weather, vendor failures, or venue issues. Especially pertinent for weddings planned during unpredictable seasons, in exotic locations, or ones that involve complex logistics, insurance can prevent major financial losses.

The cost of wedding insurance is relatively small compared to the total budget of most weddings, typically offering a reasonable trade-off for the security it provides. Many venues also require liability coverage, making insurance not just prudent but essential. Additionally, the reassurance that comes from knowing potential financial risks are covered can significantly reduce stress, allowing you to focus on enjoying your celebration.

Given the unpredictable nature of events and the substantial investments at stake, wedding insurance often proves to be a wise decision. It provides a practical safety net that can make a big difference in handling unexpected disruptions, making it a worthwhile consideration for many couples planning their wedding day.

Choosing the Right Wedding Insurance Provider

Choosing the right wedding insurance provider is a crucial step in ensuring that your big day is protected against unexpected events. Here are a few essential steps to guide you through the process.

Research Providers

Start by researching different insurance companies that offer wedding insurance. Look for providers that specialize in event insurance as they will have a deeper understanding of the industry and its specific risks. Check reviews and testimonials to gauge the reliability and customer service of the provider.

Compare Coverage Options

Not all wedding insurance policies are created equal. Compare what different policies cover and what they exclude. Pay attention to coverage limits, deductibles, and whether the policy offers options for add-ons like extreme weather conditions or additional liability for alcohol-related incidents.

Check for Customization

Look for a provider that offers customizable policies. Your wedding is unique, and your insurance should reflect that. Whether you need higher coverage limits for a lavish event or specific endorsements for destination weddings, the right provider should be able to accommodate your needs.

Understand the Claims Process

Before committing to a provider, understand their process for filing a claim. It’s important that the process is straightforward and that the provider offers support when a claim is made. Check how long the claims process typically takes, as this will be crucial in case you need to make a claim.

Consult with Your Venue and Vendors

Some venues or vendors may have specific insurance requirements or may recommend providers they have worked with successfully in the past. Getting their input can help ensure that your insurance meets all necessary criteria and might lead you to reputable providers.

Evaluate Customer Support

Good customer support can be invaluable, especially if you encounter problems just before your wedding. Ensure that the insurance provider offers excellent customer service, with accessible support to answer your questions and guide you through any issues that arise.

Wedding Insurance vs. Venue Insurance

Understanding the differences between wedding insurance and insurance for a wedding venue is crucial for ensuring you have the appropriate coverage for your wedding day.

Wedding insurance is comprehensive coverage designed to protect your financial investment from a wide range of potential issues beyond just the venue. We already described what it typically includes.

Venue insurance, on the other hand, is often provided by the venue itself and typically focuses only on issues directly related to the venue. It includes:

- Property Damage Coverage: Covers damages to the venue caused by the wedding party or guests.

- Limited Liability Coverage: Provides a basic level of protection if someone is injured at the venue during your event, but it might not cover incidents like alcohol-related accidents unless specified.

Key Differences:

- Scope of Coverage: Wedding insurance covers a broader range of potential issues, including problems with vendors, cancellations, and personal property. Venue insurance is more focused on specific liabilities associated with the use of the venue.

- Control and Customizability: With wedding insurance, you have control over the specifics of your coverage. You can choose what to include based on your particular concerns and the details of your event. Venue insurance is generally a standard package that the venue offers to all clients with little room for customization.

- Required by Venues: Some venues require you to carry their insurance as part of the rental agreement, but this typically does not negate the need for comprehensive wedding insurance, especially for aspects not covered by the venue's policy.

In summary, while venue insurance provides essential coverage for issues related to the venue itself, wedding insurance offers a more comprehensive safety net for the broader spectrum of potential wedding day mishaps. For full protection, couples often find it beneficial to have both, ensuring all bases are covered for their special day.